Results 1 to 6 of 6

Thread: 99.99 - 10 = 94.49 Wut?

-

08-08-2021, 04:21 PM #1Community Member

- Join Date

- Apr 2013

- Posts

- 5

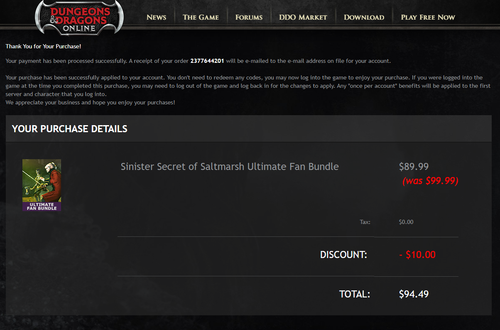

99.99 - 10 = 94.49 Wut?

99.99 - 10 = 94.49 Wut?

-

08-08-2021, 04:59 PM #2

Perhaps VAT included afterwards again ?

"You are a Tiefling. And a Cleric, with the Domain of the Sun. Doesn't that contradict each other ?" "No, all my friends are playing evil. I found that so boring that I decided to be on the good side. And, besides, Sun and Fire, where is the difference, really ?"

-

08-08-2021, 04:59 PM #3Community Member

- Join Date

- Oct 2009

- Posts

- 6,035

Great job, team DDO Market.

-

08-08-2021, 05:08 PM #4

Where are you located geographically? Is this in United States Dollars?

-

08-08-2021, 05:54 PM #5Community Member

- Join Date

- Jun 2012

- Posts

- 459

-

08-08-2021, 09:33 PM #6Community Member

- Join Date

- Apr 2013

- Posts

- 5

OK, the 5% tax thing makes sense, great catch. But you'll see in the picture it says Tax 0.00.

It also brings up other questions on IF GST was being charged after displaying a tax of zero.

Where is the tax percentage displayed on the purchase page? This is required by law

Where is the tax percentage displayed on the sales receipt? This is required by law

Where is the GST registrant number? This is required by GST registrants which SSG did not ask if I am so by default they have to provide it assuming I could be applying for an Input Tax Credit.

If SSG or their parent really is registered to collect the GST in Canada, why are they not following the law? I'm being charged a tax and according to the gov I have the right to see if the GST registration is legit by SSG providing their GST number. Yet it's not there.Last edited by MsE; 08-09-2021 at 04:39 PM.

Reply With Quote

Reply With Quote